By Maria Gerveni, Scott Irwin, and Todd Hubbs of farmdoc daily

The continued expansion of renewable diesel capacity over the next few years remains dependent on policy and market conditions. As shown in a previous article, recent growth in production capacity has been dramatic (farmdoc daily, March 8, 2023), with capacity in just the last two years expanding by 1.8 billion gallons. It is important to understand how much longer the boom in renewable production capacity will last and how much more capacity might be added. Numerous announcements about new renewable diesel plants have been made in the press, and based purely on this information, it appears that the renewable diesel boom is far from over. In this article, we provide an overview of potential renewable diesel production capacity for 2023 through 2025 and beyond. Our analysis is based on a review of capacity that can be projected with reasonable confidence and that which cannot. This is the fifth in a series of farmdoc daily articles on the renewable diesel boom (see the complete list of articles here).

Analysis

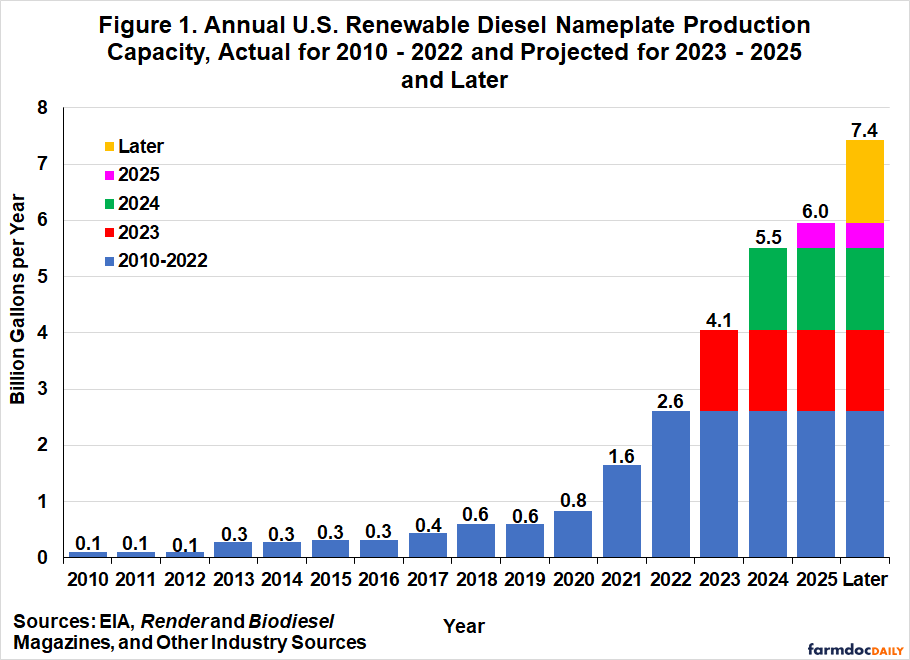

In our previous article (farmdoc daily, March 8, 2023), we presented data from the Economic Information Agency (EIA) of the Department of Energy on renewable diesel production capacity in the U.S. for 2010 through 2022 (Troderman and Shi, 2023). Staff from the EIA generously shared the data with us, and it is reproduced again in Figure 1. The data in the figure prior to 2023 represent the nameplate capacity of all renewable diesel production facilities in the U.S. at the end of the calendar year and are collected from several sources. First, the EIA conducted annual surveys of nameplate production capacity as of January 2021 and 2022. Second, this data was supplemented by company announcements and trade press reports. Note that “nameplate” capacity is the maximum output that a renewable diesel plant can produce.

The blue bars in Figure 1 represent the EIA production capacity for 2010-2022, and for perspective, the 2022 capacity is plotted as the first component of the bars for 2023-2025 and later. The original EIA article (Troderman and Shi, 2023) also included capacity projections for 2023-2025, and we were provided the annual totals for these out years. EIA’s projections included renewable diesel projects that they could confirm over the period in question with an expectation of all plants coming online as scheduled. The projected renewable diesel capacity shown by EIA indicates the potential for 5.9 billion gallons of capacity by the end of the 2025.

We developed our own estimates of renewable diesel capacity for 2023-2025 and later based on data collected from Render and Biodiesel magazines along with other industry sources. This allows us to make an independent calculation of potential plant capacity that can be compared to the EIA’s forecast during the 2023-2025 period. Uncertainty on possible capacity moving forward is intrinsic to this exercise. Delays and cancellations of plant operations will occur as has been seen during the recent build-out in renewable diesel capacity. Projected plant capacity put forth in this exercise should therefore be taken with some caution. Several projects at various stages of development that are not included in our list may come to fruition as well.

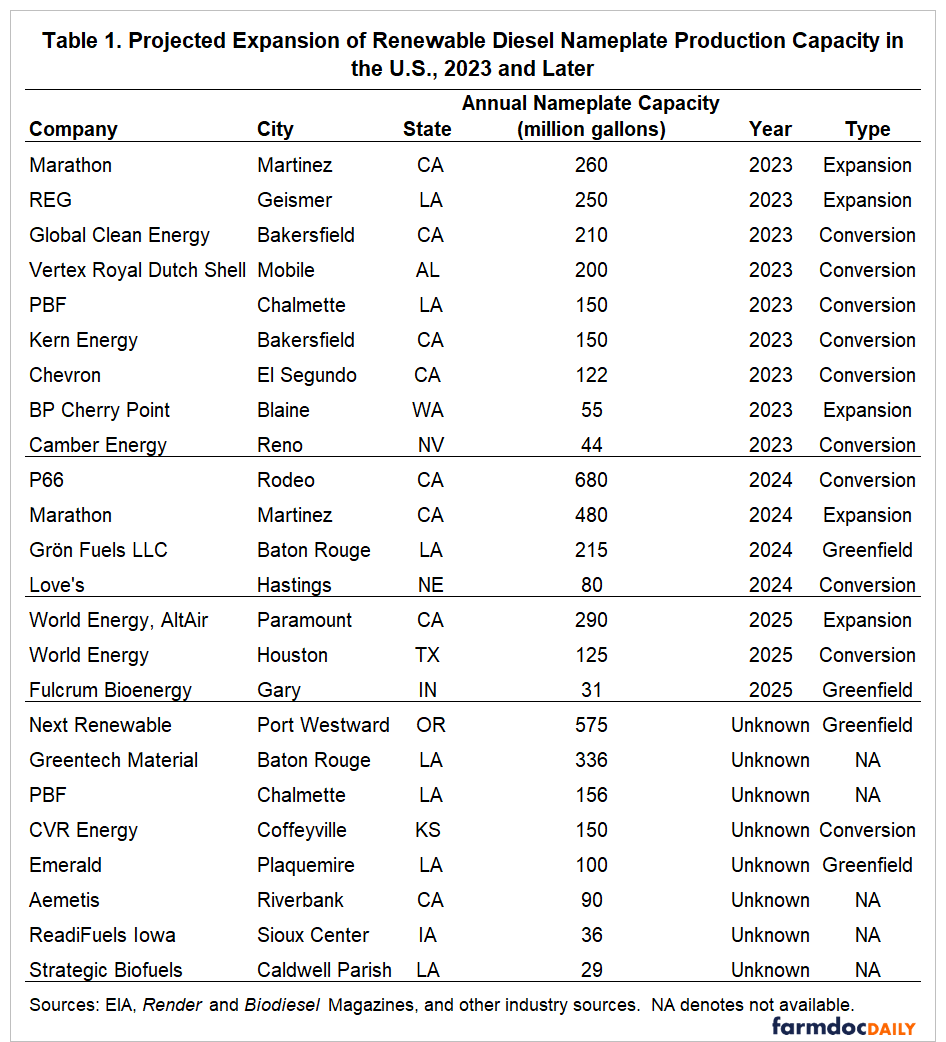

The increments to renewable diesel production capacity shown in Figure 1 for 2023-2025 and later are based on our survey of available data. The red bar shows renewable diesel production capacity increasing by 1.44 billion gallons in 2023. Our calculation of plant capacity in 2023 confirms EIA’s projection. Table 1 provides the locations and nameplate capacities of the individual plants projected to begin operation in 2023. A total of six new renewable diesel plants involving conversions of prior oil refining operations are due to come online in 2023, with a total capacity of 876 million gallons per year. Additionally, three plant expansions are due to come into operation in 2023 adding another 565 million gallons per year of capacity. The scale of the new projects is large with seven of them exceeding 100 million gallons per year of capacity and four in excess of 200 million gallons per year.

Figure 1 shows that capacity increases incrementally again in 2024 (green bar) by 1.45 billion gallons and expands further in 2025 (magenta bar) by 446 million gallons. Our calculations for 2024 show a similar total to the EIA data. Table 1 presents the four plants with a total of 1.45 billion gallons per year of capacity that are due to come online in 2024. It is interesting to note that the total capacity of the four new plants in 2024 matches the entire capacity projected to begin operation in 2023. In particular, the Philipps 66 plant in Rodeo, California and the Marathon operation in Martinez, California are massive in scale, with production capacity at 680 and 480 million gallons per year, respectively.

When we analyze announcements for 2025 and later, the prospects for capacity growth become murkier. EIA shows an additional 424 million gallons of capacity for 2025 that they can confirm. Our analysis estimates a slightly higher capacity total of 446 million gallons, but there are numerous announced renewable diesel plants with uncertain start dates. Table 1 shows capacity in 2025 with confirmed start dates and a projected capacity with all the plants announced without confirmation. Using what we classify as confirmed, projected total renewable diesel production capacity reaches 6.0 billion gallons per year at the end of 2025.

The orange bar in Figure 1 represents announced renewable diesel projects that have no confirmed start date. The less certain nature of these projects is evident in the fact that we could not determine whether a majority were conversions or greenfield projects. Having said that, total potential capacity of these projects is large at 1.5 billion gallons. If these projects are included in the total for the industry, renewable diesel production capacity could balloon to 7.4 billion gallons sometime after 2025. While the potential for these announced projects and the timing of completion remains uncertain, they have been announced and we believe should be considered in the analysis.

It is notable that the majority of the renewable diesel plants listed in Table 1 are conversions of existing petroleum refineries or expansions of existing renewable diesel operations. Only four plants are completely new, or “greenfield,” facilities. Many of the largest capacity changes occur through expansion of existing plants. This occurs because of the economies of scale associated with renewable diesel production. Of the remaining plants, over half of the known plant types are refinery conversions to stand-alone renewable diesel facilities. Stand-alone plants tend to be preferred because of issues surrounding the co-processing of renewable diesel with petroleum products (Kotrba, 2018). For example, there have been concerns about measuring fossil vs. biogenic carbon streams when assessing the carbon intensity of renewable diesel co-processed with petroleum products (Brown, 2020). In addition, co-processed renewable diesel has not been eligible for the $1 per gallon blenders tax credit since 2009 (Kotrba, 2019).

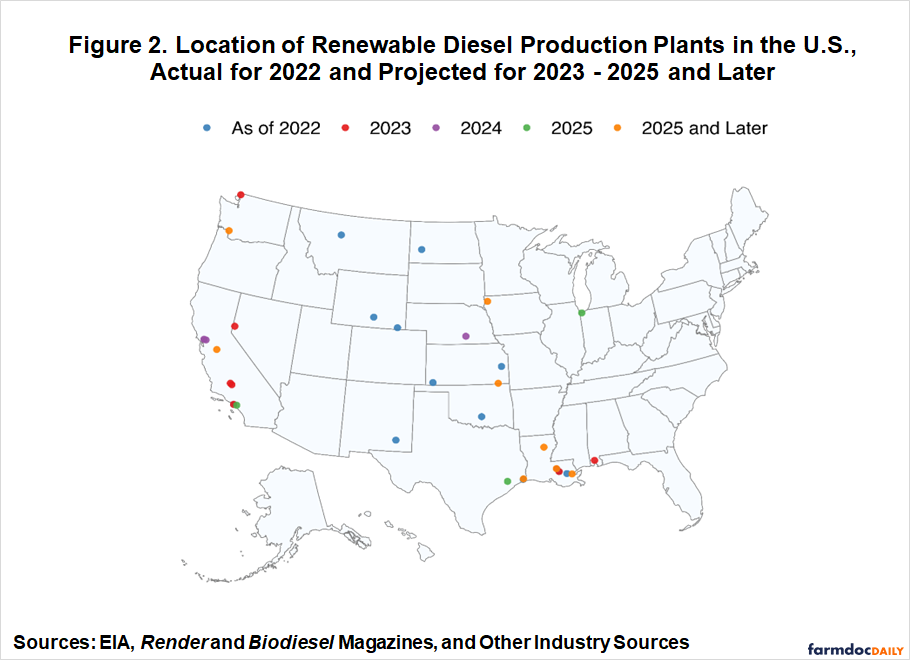

We now turn to the location of renewable diesel plants in the U.S. Figure 2 shows the locations of existing plants as of 2022 and projected plants for 2023-2025 and later. The same color scheme used in Figure 1 is used here to distinguish the year new plants are projected to come online. The new production facilities for 2023-2025 and later are spread among 11 states but are concentrated in California and Louisiana. This contrasts with the geographic concentration of FAME biodiesel plants in the eastern half of the country (farmdoc daily, February 22, 2023), but matches the previous pattern we showed in renewable diesel plant construction. The reasons stated in the previous article discussing plant distribution hold in this case as well (farmdoc daily, March 8, 2023). Briefly, the California Low Carbon Fuel Standard (LCFS) incentivizes consumption of renewable diesel because it receives a relatively low carbon intensity (CI) score in terms of greenhouse gas reduction. Additional incentives are provided by similar programs in Oregon and Washington. Second, since renewable diesel plants use petroleum refining technology, the plants tend to be located within existing petroleum refining complexes or in areas with abundant petroleum refining to ensure access to the necessary technical expertise and equipment for large-scale hydrotreating (Brown, 2020). Third, renewable diesel plants are often located to benefit from existing transportation infrastructure, such as pipelines and ports, much as existing petroleum refineries are.

Implications

The renewable diesel boom that began in earnest during 2021 looks to continue unabated over the next few years. Driven by policies in place to stimulate investment, another doubling of renewable diesel capacity by the end of 2025 appears to be feasible. The prospect of renewable diesel capacity equaling or exceeding 6.0 billion gallons per year is borne out by current announcements. There were 16 renewable diesel plants in operation as of December 2022, and another 16 renewable diesel plants that we can confirm could be operating by the end of 2025. There is the potential for even larger capacity growth given the number of announcements. The size of renewable diesel plants appears set to grow even larger, as plant expansions and conversions push capacity at the largest plants to over 500 million gallons per year. Like currently operating renewable diesel plants, the continued growth in renewable diesel capacity is being driven by large energy companies, whereas ownership of FAME biodiesel plants tends to be more locally focused.

When viewing the potential for growth in renewable diesel production capacity in the next few years it is crucial to recognize this is nameplate capacity and not necessarily capacity that will be in operation. If policy incentives and/or market conditions do not turn out to be as positive as forecast, renewable diesel projects can be canceled or mothballed, plants can operate below name-plate capacity, the mix of products can be changed (e.g., more sustainable aviation fuel and less renewable diesel), or some plants can even be converted back to refining crude oil. The next article in this series will examine supply and demand trends for FAME biodiesel and renewable diesel.

Disclaimer: The findings and conclusions in this publication are those of the authors and should not be construed to represent any official USDA or U.S. Government determination or policy. This work was supported in part by the U.S. Department of Agriculture, Economic Research Service.

References

Brown, T.R. “Biomass-Based Diesel: A Market and Performance Analysis.” Fuels Institute, March 2020. https://www.fuelsinstitute.org/Research/Reports/Biomass-Based-Diesel-A-Market-and-Performance-Anal

Gerveni, M., T. Hubbs and S. Irwin. “Overview of the Production Capacity of U.S. Biodiesel Plants.” farmdoc daily (13):32, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, February 22, 2023.

Gerveni, M., T. Hubbs and S. Irwin. “Overview of the Production Capacity of U.S. Renewable Diesel Plants through December 2022.” farmdoc daily (13):42, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, March 8, 2023.

Kotrba, R. “The Complex Dynamics of Coprocessing.” Biodiesel Magazine, October 24, 2018. https://biodieselmagazine.com/articles/2516478/the-complex-dynamics-of-coprocessing

Kotrba, R. “Historic 5-Year Extension of Biodiesel Tax Credit Signed into Law.” Biodiesel Magazine, December 20, 2019. https://biodieselmagazine.com/articles/2516870/historic-5-year-extension-of-biodiesel-tax-credit-signed-into-law

Troderman, J., and E. Shi. “Domestic Renewable Diesel Capacity Could More Than Double through 2025.” Today in Energy, U.S. Energy Information Administration, February 2, 2023. https://www.eia.gov/todayinenergy/detail.php?id=55399