Last week, legislation was introduced in Michigan creating a new incentive program for the in-state sale and production biodiesel. HB4847, introduced by Representatives John Fitzgerald (D – Wyoming), Kristian Grant (D – Grand Rapids), Jennifer Conlin (D – Ann Arbor), Matt Hall (R – Richland Township), and Reggie Miller (D – Van Buren Township), provides a $0.02 per gallon credit for the sale of B5-B10 and a $0.05 per gallon credit for B11 and higher blends January 1, 2024, through December 31, 2029. HB4847 also included a biodiesel producer credit allowing in-state producers to claim a credit against income taxes equal to $0.02 per gallon for biodiesel produced in Michigan during the tax year. The retailer credit is capped at $16 million, while the producers credit is capped at $2 million.

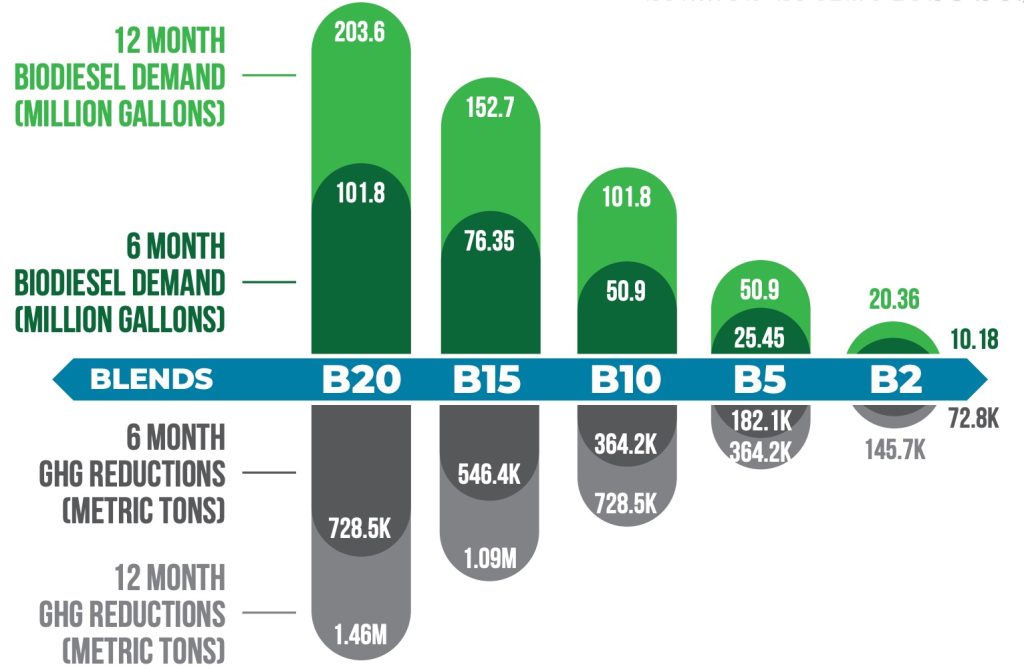

Michigan is home to 4,855 convenience stores and two biodiesel producers, Adrian-based W2 Fuel, and Sandusky-based Thumb BioEnergy. Combined, W2 Fuel and Thumb BioEnergy have the capacity to produce 15 million gallons of biodiesel from soybean oil and used cooking oil, respectively. The Energy Information Administration estimates Michigan’s diesel market to be around 935 million gallons, with approximately 27 million gallons of biodiesel consumption across the state. When fully implemented, Clean Fuels Alliance America estimates that HB4847 could grow the biodiesel market in Michigan to over 90 million gallons and reduce greenhouse gas (GHG) emissions by more than 640,000 metric tons annually.

Made from an increasingly diverse mix of resources such as recycled cooking oil, soybean oil, and animal fats, the biodiesel industry is a proven, integral part of Michigan’s clean energy future. Learn more about the benefits of Michigan’s biodiesel industry by downloading Clean Fuels Alliance America’s one-pager or by visiting our Resources page.